We’ve been thinking and talking Blockchain here, trying to pull the reality out from the hype since 2015. Recently I heard a respected colleague suggest that it’s applicable in “less than 1/10 of 1% of corporate processes”. At the other end of the scale it’s going to take over the world. So what’s the reality of blockchain’s relevance to any business model and why? I was recently asked to think about exactly that question as input for a book chapter (that didn’t quite happen), and my brain jumped to both the history of trade, the power dynamics involved and the context. This (chapter length, 20 minute read) article is the result. So let’s get down to business, but let’s go back to where business began in our human history, and think this question through from first principles.

TRADE

Trade. Commerce. We have been exchanging value with goods and services as long as there have been humans. How have the components of trade developed over time, what’s new, and how can blockchain add anything to what we now call the business model? The relevance lies in the basic components of trade and commerce, the ways they have changed, and in turn changed our society over time. In our history new technologies have triggered industrial revolutions, globalisation, and the sheer numbers at play underpin today’s amazing rate of change that informs all business. We live in exponential times.

Look at a timeline of the way trade and commerce have developed since the beginning. Modern humans have been around on the planet for 200,000 years. The start of human civilisation had to wait for the end of the Ice Age 15,000 years ago, and the process really began with the development of agriculture in Turkey around 10,000 years ago. Instead of everyone needing to be hunters or gatherers to find food, we cultivated our own crops and livestock, and that led to food surpluses and the possibility of new roles in our tribes and societies. Some of us could specialise in producing the food, while others could be soldiers, artisans, artists, builders, administrators, priests or priestesses. Urbanisation and the first evidence our archaeologists can find of organised civilisations date from 9000-6000 BC. That is when we see the first evidence of the bazaar, which comes from the Persian word bāzār. Trade began in these marketplaces that started at the edge of our villages, towns and cities, but soon moved to the centre of things. Over time these bazaars formed a network of trading centres to exchange food, goods and information, and those evolved in to our major trading routes.

Look at a timeline of the way trade and commerce have developed since the beginning. Modern humans have been around on the planet for 200,000 years. The start of human civilisation had to wait for the end of the Ice Age 15,000 years ago, and the process really began with the development of agriculture in Turkey around 10,000 years ago. Instead of everyone needing to be hunters or gatherers to find food, we cultivated our own crops and livestock, and that led to food surpluses and the possibility of new roles in our tribes and societies. Some of us could specialise in producing the food, while others could be soldiers, artisans, artists, builders, administrators, priests or priestesses. Urbanisation and the first evidence our archaeologists can find of organised civilisations date from 9000-6000 BC. That is when we see the first evidence of the bazaar, which comes from the Persian word bāzār. Trade began in these marketplaces that started at the edge of our villages, towns and cities, but soon moved to the centre of things. Over time these bazaars formed a network of trading centres to exchange food, goods and information, and those evolved in to our major trading routes.

Initially to trade with each other we developed the system of barter. Introduced by Mesopotamia tribes, adopted by the Phoenicians it spread across the world with trade itself. We exchanged goods and services for other services and goods in return. We traded in food, tea, spices, silks, animal skins, furs and weapons. Valuable commodities like salt or gold were used like currency. Actual currency came in to existence around 600BC when King Alyattes minted the first coins in Lydia, now part of Turkey.

The Silk Road started around 200BC. The most famous and extensive, ancient network of trade routes that connected the East and West through the Middle East and Southern Europe bringing silk and other goods, but also religion, philosophies, culture, ideas and even disease too. By the time of the Roman Empire lenders based in temples made loans, accepted deposits and performed the exchange of money. With the difficulties of financing long-distance trade along these routes, the Hawala system started around the 8th century between Arabic and Muslim traders as a protection against theft. It is a popular and informal value transfer system based not on the movement of currency, but instead on the performance and honour of a huge network of money brokers. The word in Arabic means transfer, or sometimes trust and that’s significant.

Later, Marco Polo travelled this Silk Road from Europe to China and around 1290 he brought back the concept of paper money to Europeans, but it took until 1661 for the first bank notes to be printed in the west in Sweden.

BANKING AND ACCOUNTING FOR TRADE

When it comes to the concept of banking itself, that really started with merchants loaning grain and produce to farmers and traders. That process developed in to what we now know as banking in Italy in the Renaissance in Florence, Venice and Genoa. The Medici bank was established by Giovanni Medici in 1397, and the oldest bank still in existence is Banca Monte dei Paschi di Siena which has been operating continuously since 1472.

We also have the Renaissance to thank for the financial bookkeeping practices we still use today. In the 15th Century Luca Pacioli, a friend of Leonardo da Vinci who was also a monk, a mathematician, and an alchemist formally codified the Italian double-entry accounting system known as the Method of the Merchants of Venice. It was the first system that allowed merchants to measure the worth of their business. Pacioli adapted Arabic mathematics to provide a system that could work across all trades and nations. Banking and accounting allowed capitalism to flourish and spread throughout Europe with major centres in Amsterdam and London, and through our trade routes to New York and the rest of the World.

We entered a period great changes. From the Renaissance to the Enlightenment. From the printing press to the first Industrial Revolution. From trade driven colonisation to the globalisation of the world economy that has been happening progressively since that time in the 15th century. All of this fuelled by new technologies and new forms of communication.

GLOBALISATION AND FOUR INDUSTRIAL REVOLUTIONS

The United States had been one of colonies, but by the end of the 19th century it was transforming to become a world power. In 1871 Western Union introduced the first money transfer service, based on its extensive telegraph network. As telecommunications developed in the 20th Century that led to another huge expansion in the banking sector. It accelerated business and markets towards a much more Internationally integrated economy. The first credit card was launched in 1946. Computers and the information technology they support have been developing rapidly since the 50s and 60s to the internet and the world wide web of the 90s. We started talking e-commerce, businesses began to need a website as well as bricks and mortar, and a significant portion of our buying and selling, both business and personal, went online. We’ve been regularly talking about digital since Nicholas Negroponte’s book Being Digital was published in 1995. The World Economic Forum tells us that we are the midst of the Fourth Industrial Revolution. The First Industrial Revolution starting around 1750 using water and steam power to mechanize production. The Second used electric power to create mass production. The Third used electronics and information technology to automate production. The Fourth we are experiencing today is characterised by a fusion of technologies across the physical, the digital and the biological. Every business is considering digitisation, digital transformation, and the way they connect with their customers, partners and suppliers. The businesses that want to survive are looking long and hard at their current business model and considering change before their competitors try and out flank them.

European banks began offering mobile phone banking in 1999, and our debit and credit cards went contactless first in the UK in 2008. During the first two decades of this century, cell phone technology, WiFi, 4G and cloud computing have advanced so that almost anyone in the developed world can afford a smart phone with “always-on” connections that allow us access to apps, maps, the web and social media. In return those devices are helping business track us and our buying behaviours so that we live more interconnected lives than ever. The first purely digital cryptocurrency appeared in 2009, and its underlying technology of blockchain, that is the subject of this post, is moving out of early adopter status to change things again, and dramatically. On top of all of this the rise of the Internet of Things (IoT) means a proliferation of connected devices, autonomous objects and appliances that do our bidding that are all reshaping life as we know it.

BUT WAIT, THERE’S MORE

It took 200,000 years for the World population to reach 1 billion, a milestone we passed in 1804. In 1974 we hit 4 billion. For those of us reading this article born on or before 1974, the population of the world has doubled in our lifetimes as we now approach 8 billion humans on the planet, growing at a rate of 200,000 more each day. Along with the amazing and accelerating advances in technology of the last 50 years, that means more of everything. More ideas. More creativity. More products in more categories. More choice. More competition. More transactions. More mouths to feed and more challenges.

So the exponential times we live in are driving the rate of change even faster. The statistics are staggering. We’ve discussed how trade has moved from barter to use of currencies, with banks and merchants getting involved, although barter is still valid. Our physical marketplaces have connected in to trade routes, evolved, gone global and been supplemented by telecommunications and the online world. What are the other ingredients of trade that we should consider, and how have the power dynamics changed over time?

BALANCING TRUST AND RISK

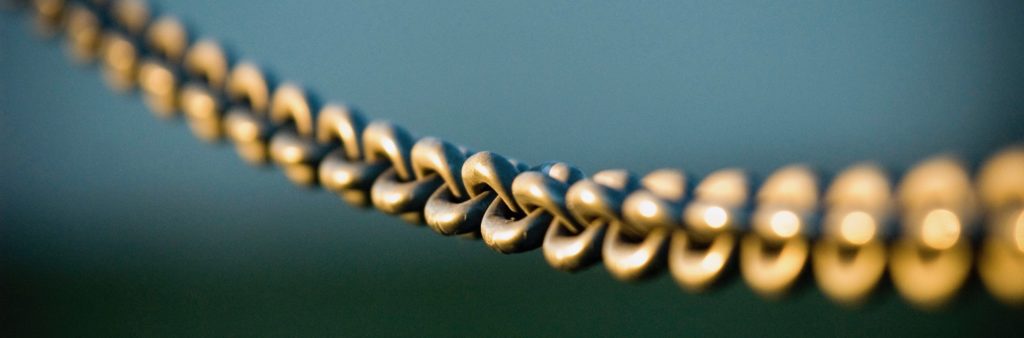

Back at the bazaar when we are bartering our goods or services, how trustworthy is the person we are trading with? Does that person have any certification or proof that they are legitimately who they are supposed to be? Are the goods or services they are exchanging with us genuine or defective in some way? Are they the age and condition that has been represented to us? The goods may be genuine, but are they actually owned by the seller? Are there any guarantees or warranties if anything goes wrong. Is there some insurance we can buy, or some method we can deploy to assure our goods aren’t stolen? Does the marketplace itself offer us any protection? As buyer and seller we negotiate and eventually agree an exchange of value by handshake or some form of contract, but were the terms of our agreement fair? If currencies were involved was the exchange rate valid for these circumstances, and were those currencies real or counterfeit? How is the exchange between buyer and seller actually executed? Standing face to face in the marketplace we can see each other and exchange our goods or the currency simultaneously, but if there is some production process or a promise of delivery, who will oversee and guarantee the delivery and the payment? Then as products and services get ever more complicated, and as globalisation and communications get involved, all of these issues multiply and extend across the distances involved and each link in the chain of supply from buyer to seller across a network of the intermediary businesses that join the transaction.

The key elements in this trading landscape, from the bazaar to today’s complex, technology driven markets, have always been about balancing trust and risk. Those two are involved at every stage of the process. From the beginning of trade in the bazaar to the present day we have created instruments of trust to help reduce those risks. Each buyer and seller has begun to record their transactions or tracked their assets in their own ledgers or other record keeping systems. We have minted coins and paper money with steps against counterfeiters to certify at least one side of the value exchange. We started to use trusted third parties with their own centralised systems to oversee our business transactions and to become part of the chain. The banks and their banking systems have evolved to help trade, keep our money safe, and they add further instruments to help us like letters of credit. We involve brokers to connect us with sellers, lawyers to oversee our contracts, accountants to keep our books, track our records and other third parties including governments to set, certify and verify the standards and quality of the goods and services we exchange.

All of these parties and the measures they employ reduce risk, but they add costs and inefficiencies across the business network. Each of these intermediaries charge fees for their services. They add steps in to the process, and introduce the possibility of delays in executing agreements or getting things done. They add cost and time with the duplication of effort required to maintain numerous ledgers to keep track of the transactions. They also add additional vulnerabilities. What if a bank or any of the parties’ centralised systems were compromised by fraud, a cyberattack, some system failure or by a simple mistake? The whole business network could be compromised.

CLARIFYING THE BUSINESS MODEL

So what can we do differently with new technology like blockchain? Before we answer that question, let’s explore what we now call the business model. In their 2005 paper Clarifying Business Models: Origins, Present, and Future of the Concept by A. Ostenwalder, Y. Pigneur, and C.L. Tucci, they describe the business model’s place in the firm as the blueprint of how a company does business. It is the translation of strategic issues, such as strategic positioning and strategic goals into a conceptual model that explicitly states how the business functions. Ostenwalder and Pignuer went on to develop their ideas in to their excellent book Business Model Generation. That provides an approach to discussing the business model in 9 components – key partners, key activities, key resources, value propositions, customer relationships, channels, and customer segments, all underpinned by cost structure and revenue streams. Where on this canvas can blockchain be applied to add value, increase efficiency or reduce cost?

THE BLOCKCHAIN GOLD RUSH

Blockchain technology is in the process of moving from early adopter status towards mainstream use but unfortunately, we are in the midst of a “Gold Rush”. There is too much hype and not enough substance in some of the reporting around the topic. Some companies have managed to increase their valuations simply by adding blockchain in to their name! Beyond today’s heat, or the backlash of bad press it’s likely to cause as some of the current projects and start-ups fail, there is real value to be found “in them thar hills”. So what can blockchain really do in practice for trade and how is it disruptive?

WHAT IS IT?

A blockchain is a distributed (peer to peer or decentralised) ledger, implemented across many networked servers, consisting of a continuously growing list of records, called blocks, which are linked across the whole network and secured using cryptography. You can have an open network that anyone can join, or more usually in enterprise implementations, a group of partners join an agreed business network. In addition to the ledger, business rules and smart contracts that execute automatically in a transaction, based on one or more conditions, can be built into the platform.

Traditional database technology always has some central party or owner giving access and administration rights that we have to trust to use their ledger. A blockchain ledger has those rights distributed to every node or partner in the network equally. This allows several parties or even competitors to share a trusted digital ledger across the network of computers without the need for any central, controlling authority. A single version of the truth. The combination of the cryptography used to safeguard each block, in conjunction with the fact that each block addition is “witnessed” and instantly replicated across all the servers in the network means that, in practice, no single party has the power or resources to tamper with the records. The ledger becomes immutable.

A few words of caution that we’ve blogged about before. An open blockchain could have any number of servers that all need to replicate every added record simultaneously. That might soak up a lot of computing power and energy, as well as not allowing much of a transaction rate through that ledger. This is exactly why enterprise implementations of blockchain usually deploy a closed or permissioned group of partners in a particular business network. That’s the position today. We’re at an early stage which you could liken to the early days of the Internet and the World Wide Web, but more on that later.

WHAT DOES BLOCKCHAIN SOLVE?

The problem we are solving here is at the core of all trade – trust. Blockchain’s key advantage is that the buyer and seller, the other parties or competitors that are involved can trust the validity of the distributed ledger without the need for any intermediary like a bank or broker or lawyer or government being involved. No reputation required. It eliminates the need for the duplication of effort that always happens amongst the parties involved, and reduces the need for those intermediaries. It changes the backbone of business. This is why the banks and financial institutions have been amongst the first to make big investments in to understanding and developing this new technology. Blockchain has the power to significantly disrupt their core business model as the key intermediary and the central overseer of trade. This is why blockchain developer skills are at a premium.

It is important to note that while blockchains contain transaction data, they are not a complete replacement for the existing database technology, transaction processing or messaging systems that they will always sit alongside and connect to. Blockchain and the Distributed Ledger concept adds something new. Blockchains contains verified, immutable proof of transactions or the recording of assets with benefits that extend far beyond those of a traditional database.

WHAT CAN IT DO?

Blockchain means that business networks can be simplified. The end participants in a trade, the buyer and the seller, stay the same but the need for intermediaries can be removed or reduced. The underlying transactional system can change to be simpler, more efficient and more open as all parties can share the same transaction record in the same ledger, rather than having to maintain one of their own. A secure blockchain business network can provide:

- Enhanced privacy so that only those parties with permission can access the ledger. Depending on the application permissions might be extended to auditors or regulators where appropriate.

- Improved transparency and auditability as everyone in the business network is working from the same ledger which is a single source of the truth.

- Increased operational efficiency by removing the traditional extra steps and intermediaries, and streamlining the transfer of the assets and value exchange.

Here are some examples of how blockchain technology is currently in action changing things:

- In 2006, a USA outbreak of E coli was linked to bagged spinach. It took regulators 2 weeks to conduct the trace back and determine the exact source of the outbreak. The IBM Food Trust network including a consortium of Walmart, Nestle, Unilever and others means that the same trace can now be done in 2.2 seconds.

- In February 2017 Northern Trust launched the first commercial deployment of blockchain technology for private equity. Audit firms can now carry out audits of private equity lifecycle events directly from the blockchain in real-time.

- IBM and shipping giant Maersk have formed a joint venture that offers a jointly developed global trade digitization platform built on open standards and designed for use by the entire global shipping ecosystem. It will address the need to provide more transparency and simplicity in the movement of goods across borders and trading zones with the digitisation and automation of paperwork filings for the import and export of goods.

- Modum is a Swiss company who provide data services for pharmaceutical companies. Their platform uses smart contracts and external IoT sensors to track environmental conditions for pharmaceutical products while in transit to help with regulatory compliance in the European Union, which requires proof that the products were maintained in certain conditions during transport.

- Spanish bank Santander has become the first company in the world to use blockchain to confirm each shareholder voter’s digital identity and so make it easier and more secure for investors to vote at an annual meeting.

The European Union Intellectual Property Office (EUIPO) is investigating how blockchain could combat counterfeiting. Estonia was the first government to explore blockchain technology and their e-Estonia programme connects government services in a single digital platform. The USA’s Food and Drug Administration (FDA) announced it had signed a two-year joint-development agreement with IBM Watson Health to explore using blockchain to securely share patient data. Dubai wants to become the first government in the world to conduct all of its transactions using blockchain, with a target deadline of 2020. In the UK HM Land Registry is exploring the technology to support their stated aim of digitising and automating 95% of their daily transactions by 2022.

The complication we have today is that not enough of these projects have gone beyond proof of concept to successful, enterprise scale, live solutions. Since the concept has been around for almost a decade that’s a problem that, collectively, we need to fix.

The potential applications and benefits of blockchain technology apply across all business sectors, and each area of the business model canvas. It can help simplify international payments in banking, or clearing and settlement in financial markets. It could revolutionise land registry for individuals and governments, or access to medical data for health and life sciences. It can improve traceability in the supply chain and asset tracking, both physical and digital, across a whole host of industries or government applications. Secure digital identity will have huge ramifications for fraud prevention, compliance and for the provision of government services.

Land ownership, intellectual property and the role of the trusted intermediary mean that the legal profession is interested too. On top of the implications of the immutable ledger, smart contracts can be encoded in the blockchain technology. Clauses can be made partially or fully self-executing, self-enforcing, or both. The purpose (and potential) is to provide superior security compared to traditional contract law while reducing the cost and time associated with creating, agreeing and executing traditional contracts. Like the banks the major law firms are looking at their current business models and client relationships, looking for new ways of unlocking value, and so they are investing and exploring the possibilities too.

CONCLUSION

We asked where on the business model canvas can blockchain be applied, and the answer is in all 9 segments. It can be used to change the relationships you have with your customers, suppliers and channel partners. Companies will need to rethink their traditional business processes and change from business as usual to harness the efficiencies and the values blockchain can release, but we need to recognise that blockchain is evolving. As we said earlier, this is like the early stage of the Internet in the 90s. Back then it was a time of huge potential, rapid change with factors most organisations were only beginning to understand. At the start the scope was limited and the user experience was clunky. Major players in the sector like Google or Facebook didn’t exist or what they do wasn’t even conceived of as being useful yet. Fast forward to now and the Internet and these companies are part of the fabric of every day life, business and personal. Today we are still at that early stage in the development of blockchain’s distributed ledger capabilities, with technical solutions to questions we haven’t even asked yet still in the future, but not far away. Relevant to your business model? Relevant to trade? Trust me, take it seriously and factor it in to your transformation planning.

Challenge me if you disagree. Contact us if you want to talk blockchain, business transformation and digital enablement.