French Social Business research company Lecko brought out their 2015 analysis of the French market in February, and they presented some of it at the Enterprise 2.0 Summit in Paris. But don’t let the “French” bit fool you, there is a lot of content in it that is useful for any country, including the UK. They have produced a version in English now, it is a very detailed piece of work, some 130 pages of detailed research, the first half of which we have summarised below. There are quite a lot of takeaways for the UK market in this (The report can be downloaded from the Lecko site over here, for free).

The report is structured in 4 sections:

1. Collaboration, the kingpin of digital transformation – deals with the ongoing evolution of the Social Business arena, and the evolution of the Enterprise Social Network (ESN) and the core position of Collaboration systems in driving value

2. Organised transformation – what companies are doing about Digital Transformation today, and how they are going about it

3. Constructing a collaborative offer – how they are implementing the software tools and systems

4. Market analysis – a detailed analysis of the software tools themselves – they have analysed 38 of the current software systems globally, from major players such as Jive, Broadview, Yanmmer and Sharepoint to innovative startups systems. A very useful part of this is the analysis of the systems that front-end Sharepoint.

The last section – Market Analysis – is about half the report, so we will summarise it in a second blog post. This post will deal with the first 3 sections.

Collaboration, the kingpin of digital transformation

The “kingpin” is the pivot for a steering mechanism. Lecko’s view is that in the emerging Digital Transformation, the Enterprise Social Network, with its ability to track events outside and inside the enterprise, will be key. Their argument will sound familiar to most practitioners – the digital world is forcing companies to change, so the company must anticipate major changes to its offer (before change is forced upon it). I think they make two useful points in the discussion:

– Tomorrow’s assets are different from today’s – i.e the “means of production” that are valuable today will not be tomorrow. I think this is a key to driving change, mainly in terms of avoiding (i) the “sunk cost” problem – just because you’ve spent money on it doesn’t mean it’s valuable; and (ii) the “this has always worked before” issue.

– Change breeds change – the need to changing culture and organisation so it has the means to change

They also do not believe there is a “right” organisation structure – their research implies the best is to look at the best organisational methods in each area of the company.

All in all we liked this, as it agrees with our research into lessons from the past 🙂 But a pertinent point is that our research is from global examples, so we would argue that the Lecko work is also applicable far outside of France (our view is that most OECD economies have more similarities that differences, excepting the UK is more of a “trading” than a “making” economy compared to Europe or Japan so the emphasis on Social services for market making is higher.

Organised Transformation

This section looks at the “how” – they analyse 4 main areas of how companies approach transformation:

– The strategic approach: Management has a vision and calls for organisation based on discussion and movement within the company.

– The tooling approach supported by the IT department: It is incorporated into the continuous modernisation of corporate collaborative tools.

– The business line approach: A business line manager relies on SaaS solutions available online to initiate the approach without the need for an IT project.

– The individual approach: Employees rely on their chosen online services to become more efficient.

The research is from a detailed base of 22 CAC 40 companies that Lecko monitors (The CAC 40 – Cotation Assistée en Continu – index represents a measure of the 40 most significant values among the 100 highest market caps on the Euronext Paris – formerly the Paris Bourse). The main conclusion is that the current dynamic around digital transformation suggests that much work so far is by individual projects and pioneers, and companies need to strengthen the “strategy” and “business line” front. The research also looks at the awareness at top level of the digital issues and the choice to recruit a Chief Digital Officer responsible for constructing a strategy and executing it. In this area they find that:

40% of CAC 40 companies have appointed a Chief Digital Officer. Reporting to the management team, the CDO is responsible for the company’s digital transformation. The missions and tools available do, however, vary from one company to the next. This change began 2 years ago, which shows that companies were becoming aware of this strategic issue.

80% of CAC 40 companies have at least one enterprise social network. 75% of CAC 40 companies have access to a cross-functional Group ESN for all employees. All of these companies are not, however, at the same stage. Having an ESN does not mean it has been successfully populated either.

80% of communities are the result of community manager (CM) initiatives (alone or with colleagues), 15% are communities controlled by management, 5% of CMs take over initiatives started by others. The challenge is recruiting the CM’s and helping them to succeed. 71% of succesful communities have high CM involvement.

Usage is becoming more intensive. The commitment index measures the level of commitment of the 1,000 top users (with more than 6 months of activity to avoid the early-day curiosity peak efect). In 2014, it increased 17% on the panel’s platforms (compared with 18.2% in 2013 when the survey started).

These outcomes don’t look that different from other countries, nor are their findings on the typical path, they note the digital transformation typically :

– began with the replication of existing models filtered down into the digital world (website, e-commerce),

– arriving today at a more structural change (rethinking of the customer journey through all digital and physical channels)

– incorporate digital social technology more remotely – into stores etc, plus association of the digital technology with the products

– (starting to) create new services in line with the opportunities of the digital era.

Barriers to progress in France are also similar to elsewhere – the successes of the pioneers are difficult to reproduce across the organisation as it is not so much the final useage that counts, but how the pioneers succeeded to leading their colleagues through the change. In scaling up though, operatives are short of time and are tempted by strong-arm action to roll it out quickly. In summary, the core barriers to roll-out are:

– Lengthy change: the aim must be to get the company to learn, and this takes time

– Complex: cultural barriers exist at all levels (significant inertia, more than resistance, is widespread)

– Disruptive: often difficult to move the existing situation forward, it is about finding new solutions for those taking the reins. Competition and cannibalisation need to be managed carefully.

– Combination of simple innovation and smart methods is required.

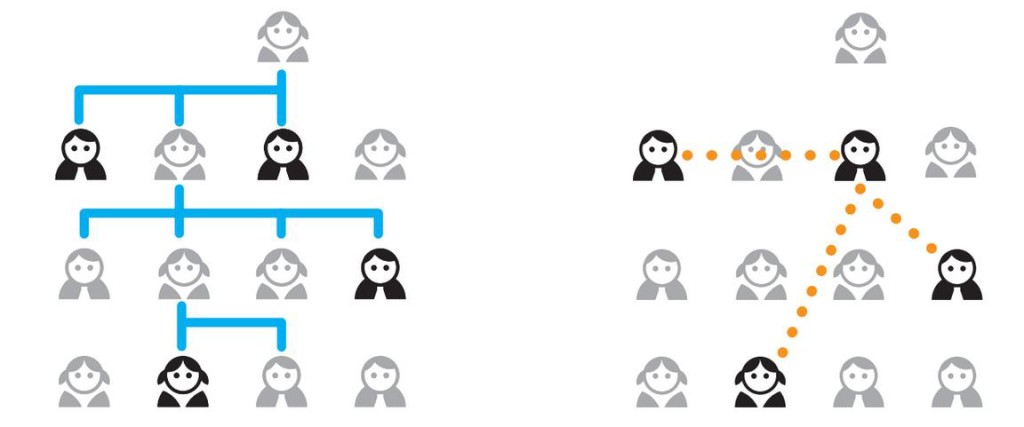

One finding that echoes with our observation is that initial investment is often outsourced by early pioneers before being reintegrated into the company (Cloud based 3rd party services etc). These early projects make the company reliant on initiative leaders who can unite their colleagues around their project. Downside is that this situation results in the company’s overall efforts becoming fractured, with various digital appendices and so overall evolves less quickly. Hence the need for the CDO, who has to integrate the Strategic, IT, Business and Individual approaches referred to above. This is detailed in the chart below:

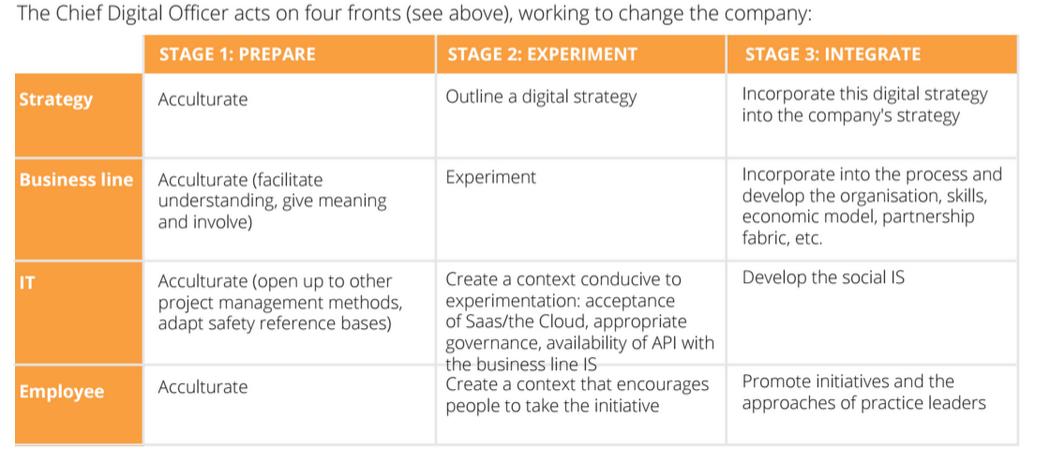

On the “what are they doing” front, there are interviews with several CDO’s from a range of large French companies. One of the key requirements is to start to integrate and co-ordinate the projects around a company, typically creating a central project team to do so. There is also a useful summary chart of what seems to work empirically (below):

Two key drivers (the axes) are:

1. Create Value for local entities

– Services delegated: management training, provision of statistical reports, transmission of a communication kit.

– Knowledge passed on: training to coach local teams, training and provision of tools, management of sharing practices and sharing of reusable sources

2. Overall Transformation leadership

– Definition of a framework consisting of rules to follow: the governance rules and the support process are imposed.

– Create a consensus around shared, collective objectives: encourage discussion and convince people of the direction to take, manage sharing of practices and convince people to act

In short, the centre has to control by a combination of persuasion and governance, while ensuring there is enough “whats in it for me” for the various local units to be motivated to adopt new services. To me the most pertinent observation was that the CDO is not (yet?) a “C level” job (ie top management tier role) so I’m not clear how they the CDO can do this task, as they are unlikely to have the budget or influence to really drive change.

Constructing a collaborative offer

This section is a summary of steps a company should use to think about constructing a collaborative system – it’s roadmap, if you like. In short the key tasks are to:

– Distinguish between mature and disruptive emerging uses ogf the existing systems in a company (eg email, office tools etc)

– Choose the right technologies – key is to distinguish between technologies athat are part of the “general case” Enterprise Social Network, and those that are task or operation specific (this is mainly what the second half of the report, the product analysis section, is about – which we cover in a subsequent post)

– Difficult to make up for a lack of integration – as noted in the xxx section above, if there are multiple cativities many problems satrt to occur that hinder rollout and seamless workflows. Unless one collaborates in building Collaboration/Communication systems, they won’t collaborate or communicate …. (this stuff isn’t new, this aspect of rollout seems to be a company perennial issue)

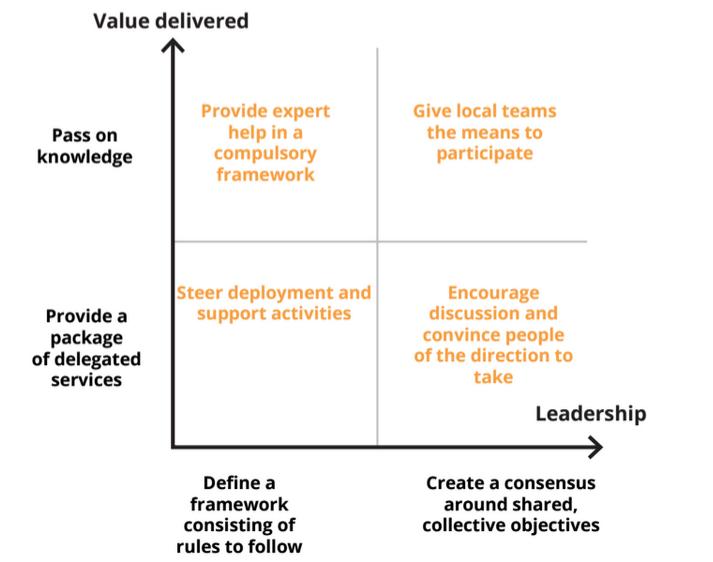

– Position tools and uses – this follows obn from above, ie the taske define the tools – the diagram below is a useful framework to think about the lifecycle of various elements in the roadmap, looking at collaboration technology scope vs information governance (usage, persistance, privacy etc)

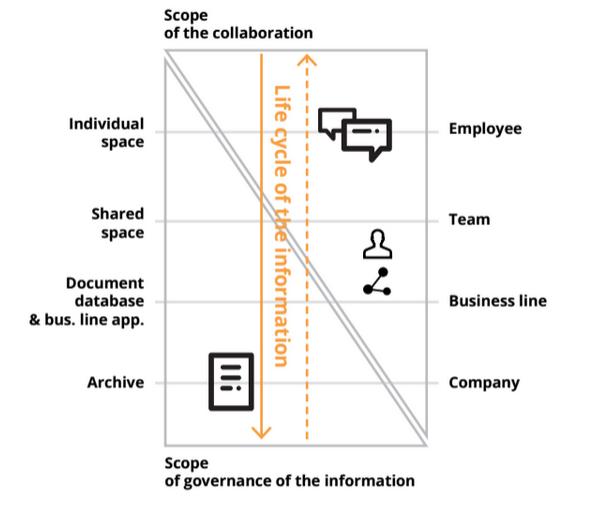

Lastly, Promote and support this – you need traditional training based implementation approaches, but they are not enough – you have to win people over too (especially if the change is non-negotiable). This is expressed in the chart below – as I read it Lecko believes the “what works” is using both traditional and learning organisational practices to complement each other, depending on the situation.

In conclusion, although there are a few things which may be French specific I think they are minor compared to the huge number of datapoints that are echoed in other countries, so as a review of the “what works, what doesn’t, what’s next” sort of analysis we use, it is a very useful new study. We would argue that the “4 actions” model they use – Strategy, Tools, Business Line & Individual – is better covered by the more comprehensive 7S model (Strategy, Systems, Structure, Staffing, Skills, Style and Shared Value – aka Culture) but that is a minor quibble – all the aspects of the 7S are covered in the report. What also comes across is the continual use of pragmatism in the real world implementations – i.e. use what works, drop what doesn’t – and the continual themes of integration being critical, a bunch of disjointed initiatives will at best underperform at worst die.

The next post (see here) looks at the second half of the report – the evaluation of the IT tools market evolution, and the evaluation of c 35 products in it.