I have been following the development of Tim O’Reilly’s “WTF” (Work – The Future) essays as it may be a useful gathering point for a lot of the emerging thinking about the space, which is very scattered right now.

One of the essays is on the replacement of Firm based value chains with networked value chains, the argument as to why this will happen is effectively Coasian. Ronald Coase looked at why firms existed in the 1930’s, and came up with the idea of Transaction Costs, those small frictions in doing business. Coase argued that a firm exists when Transaction Costs make it cheaper to operate a business as a managed entity rather than have to buy from/write a multitude of contracts with mutiple suppliers for every little thing.

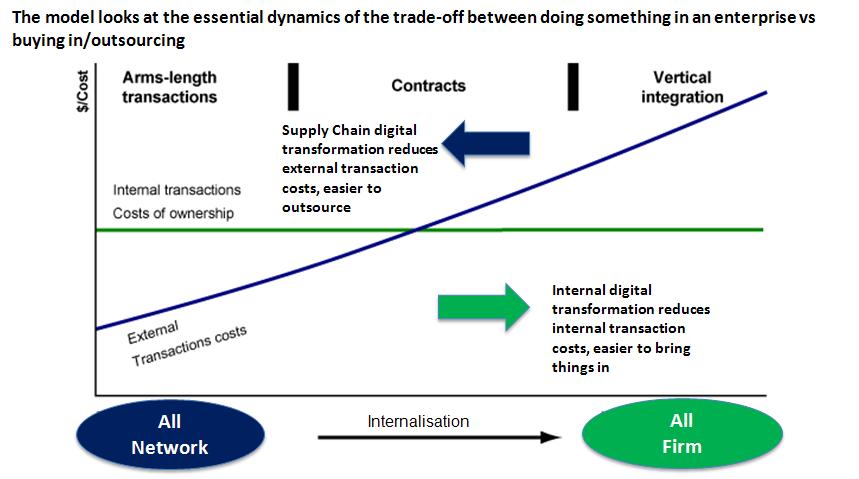

The diagram above shows how this works.

The rising Blue line shows the increasing Transaction Cost as the transaction becomes more complex from left to right.

- Arms Length transaction – buying a coffee – very simple, very low cost to perform

- Contract – a more complex transaction, something needs to be set up before/during/after a simple transaction

- Vertical Integration – a very complex transaction, typically used where there is a need for synchronisation with upstream and downstream activity.

The horizontal Green line is the cost of doing any transaction within a firm, essentially it is a fixed cost of overhead, so any in-Firm transaction costs are in effect the same. Coase argued that the Firm will want to do all the work internally where the Green line is below the Blue, as this costs less. As expected it tends to be the more complex transaction that the Firm will take internaly.

And this is how it has played out to date. As the industrial revolution gathered pace, firstly it was easier to integrate a series of vertical activities in a Factory, and then get efficiencies of scale and automation via unified operation, and we have the modern “traditional” Firm emerging. Small craftsmen and guilds were squeezed out as this process intensified. It also became easier in some industries to contract for someone to arrive at work every day, on a one-off employment contract, rather than negotiate with work gangs every day, so workers were hired on long term employment contracts. There was “peak integration” in the early 20th century when companies like Ford did everything from mining iron to repairing cars, but that was a temporary phase. (This is a subject in itself, for another post, but in essence scale and complexity adds exponentially to transaction costs)

Most company value chains today look like the diagram above, where some work is carried out in Firms, some is contracted out to suppliers and contractors. The impact of 50 years of ICT is that it is continually reducing transaction costs across the value chain, and the argument of some people is (and has been for c 10 years at least, I may add) that we are getting to a “tipping point” today where the gap between today’s transaction costs and how most Firms still work are large enough to create a disruptive movement in the blue line/green line crossover point, far to the right, and we are looking at New Ways Of Working. This view is explained in an essay on the subject by Esko Kilpi in the WTF canon. In essence, the argument is that technology is dropping transaction costs outside the Firm faster than within it, and thus the structure will shift from Firms as intermediaries between customers & suppliers- ie the green line will move to the right, and work will move to a multiplicity of suppliers and contractors in networks, delivering services at lower transaction costs. Kilpi argues:

What really matters now is the reverse side of the Coasean argumentation. If the (transaction) costs of exchanging value in the society at large go down drastically as is happening today, the form and logic of economic entities necessarily need to change! Coase’s insight turned around is the number one driver of change today! The traditional firm is the more expensive alternative almost by default. This is something that he did not see coming.

(Hmmm..Coase would have known the cost is shiftable either way by definition). Anyway, Kilpi argues that the outcome is that:

Accordingly, a very different kind of management is needed when coordination can be performed without intermediaries with the help of new technologies. Digital transparency makes responsive coordination possible. This is the main difference between Uber and old taxi services. Apps can now do what managers used to do.

For most of the developed world, firms, as much as markets, make up the dominant economic pattern. The Internet is nothing less than an extinction-level event for the traditional firm.

There are two major caveats with this line of reasoning, however:

- Firstly, ”If” – as in “If the (transaction) costs of exchanging value in the society at large go down drastically”….. This “If” has a rider, which is there will only be a shift Also If the transaction costs of Firms also do not reduce, i.e. are not equally affected by these same technologies. If those In-Firm transaction costs also go down, using the same sorts of technology, then there will not be a great shift to “exchanging values in the society at large”.

- Secondly, what are these replacement economic entities going to look like when the firm sheds transactions? Who will operate and own them? Will they be bedded in the “society at large” or not? There is an implication in Kilpi’s work that these are not intermediary structures, the WTF essay assumes they will be set in these newfangled Internet networks and called “Plaftforms”. However, if you look at the example given in the essay as a harbinger of the new – Uber – it is clearly just another Firm, using t’Internet rather than t’Phone. As to value exchange, it remains a centrally placed intermediary. All links lead to and from Uber. All transactions (logistical and financial) are routed through Uber’s servers, within its own network. If this is a “new” network economy, it is a highly centralised and closed network, with all nodes owned and run by Uber, as any before. All that “society at large” is doing is supplying or ordering a taxi ride and paying for it at the edge if the network, as it did before, just that now its by App transactions rather than ‘phone or hail ones.

In this case one “traditional” Firm, the original Taxi Company (or in fact many Taxi Companies), have just been replaced with another, newer, one – Uber. A new Firm has used newer technology to reduce the transaction costs in a well worn existing business model (order taxi – route taxi – pay taxi) and is now using good old fashioned In-Firm competitive advantage to take market share from existing Firms with higher transaction costs. Uber only needs a “very different kind of management” insofar as it is managing more machines, less people in its workflow. It’s network is a good old heirarchical network, just more automated.

Same web, different spider.

So what is the real competitive advantage here? This is not a replacement of today’s intermediaries by some new, paradigm shifted economic entity. It is merely an automation of labour within today’s standard operating model. There are still taxi drivers and customers, needing roughly the same transactions to manage the service. Apart from getting a smoother taxi ordering process it’s just business as usual, there has been no fundamental transformation of the value chain, that a competitor cannot replicate to a “good enough” standard, fairly quickly. Looking closely at the real economic differences, it seems that some of these transaction cost reductions are due to evading existing labour rights and supplier/customer regulations – a point conveniently avoided in many discussions, but again one has to ask how sustainable this is (see further down the page).

At this point it’s worth introducing another counter-intuitive issue of the new technology is the following – Kilpi is correct when he says that:

“Managerial overheads increase as the organization grows. Whenever the transaction costs inside the organization reach the level of the transaction costs in the markets, markets outperform firms and outperform central planning/management coordination in general.

The Internet, together with technological intelligence, makes it possible to create totally new forms of economic entities, such as the “Uber for everything” -type of platforms/service markets that we see emerging today. Very small firms can do things that in the past required very large organizations.”

However, the corollary is that if a Firm improves its internal transaction costs at a faster rate than than the outside markets, it actually becomes more efficient and thus can bring more functions inside itself. I would argue that baed on current evidence this “Uber for Everything” world is currently not going to evolve to any form of new non-intermediary economic entity, or some form of value sharing network. Instead the trend is towards becoming a line up of lower transaction cost super-Firms, large intermediaries each dominating it’s own industry sector with its own efficient centralised network, and walled gardens to maximise internal value (you can’t take your reputation from Uber to Airbnb, for example). There is a trendline of huge New Firms establishing sector dominance – Google, iTunes, Amazon, Facebook, soon Uber?

Transaction Costs per se are clearly only a part of this story.

Just follow the money – these UberFirms would not have “Unicorn” valuations if the surplus in the value chain was going to be spread across a host of other small players in a network, their backers are taking a Firm bet on where much of the surplus ends up.

And follow the spend – its all about market growth, including using investment money to undercut incumbents to gain mass market share fast, and increasingly to lobby against forces trying to recreate level playing fields in terms of regulation & employment laws.

In fact the major economic drivers of these UberFirms’ advantage are not the technology driven transaction cost reductions from ICT, but the labour and regulatory savings. And this has been true overall for many a decade. The big driver of outsourcing was lower regulatory and labour costs in developing countries, not the transaction cost reduction from adoption of ICT on every desk and cheap global telephony. What has really changed in UberFirms is who the employees nominally work for, their working conditions, and which regulations the UberFirms believe they can avoid.

However, there is already starting to be pushback from existing competitors, regulators and employment institutions to ensure a more equal playing field. This is why, as these efforts are starting to level the field, some of the Uber-alles plays have already had to shut up shop. Uber’s own model is under attack and it is having to shift more of its resources into lobbying, undercutting competitors and public pressure to keep the arbitrage gap open (….long enough to IPO at Unicorn valuations?).

Where Kilpi is spot on is when he says:

We stand on the threshold of an economy where the familiar economic entities are becoming increasingly irrelevant. Technological advances, like smartphones together with cloud computing, allow people to have a computer in their pocket that is more powerful than any in the world 20 years ago.

But again the impact is counter intuitive. What has happened in effect is that though the processing capability of a “wired” customer or service supplier has gone up dramatically, this typically has not facilitated any major societal value shift or new societal network emergence. If anything, the history of the Internet since c 2010 is an increasing walling off of what were once open societal network areas, even as end user devices have got more powerful. What has happened is that an increasing part of the “hard to automate” workflow is outsourced to the supplier and user at the network edge (via their smartphones) and much within is automated. But whether it’s Google ousting Yellow Pages, Apple iTunes ousting Tower Records (Napster was truly Societal, and look what happened there 😉 ), Amazon ousting the local bookshop or Uber ousting a Taxi firm near you, a Firm is still very much in charge.

So to conclude, the statement that:

“The Internet is nothing less than an extinction-level event for the traditional firm”

Is true, but is qualified – If:

- The traditional Firms cannot digitally transform themselves sufficiently to compete well enough, soon enough.

- The UberFirms can avoid a levelling of employment & regulatory conditions, and afford to undercut long enough, to drive the traditional Firms out of business.

If….

That is the traditional Firm’s challenge…… and some will fail. But it is far from a given that existing players cannot win this game. How an existing player can compete will depend on the sector, but some the obvious things to do are to:

- Keep the UberFirm at bay while transforming yourself, by persuading authorities to create a level playing field in terms of employment conditions & regulation, and delay or limit entry until this is done

- Use positional advantages to give customers value from existing asset bases that the UberFirm then has to subsidize

- Restructure their own operating model where they cannot achieve the above. (This is however culturally often very hard)

- Adopt the new technology to bring their own transaction costs down to a “good enough” level to retain customers

- Focus on your market, and the scale really rquired to serve it – do you actually need more than one city to be a great Taxi company?

We will examine the real operating economics of these new UberFirms, what traditional Firms can do in response, and how a genuine networked economy may come about in more detail in subsequent posts.

As an aside, we are running our 2nd London Digital Enterprise Summit on October 22nd – details, speakers & agenda are over here